Department of the Treasury

Department of the Treasury

(TRENTON) – The Department of the Treasury testified before the Assembly Budget Committee at the State House today, providing a detailed update on revenue projections for the remainder of Fiscal Year 2023 through Fiscal Year 2024 after analyzing collections for the all-important month of April.

The following is a copy of the testimony, as prepared for delivery:

ASSEMBLY BUDGET COMMITTEE HEARING

State Treasurer Elizabeth Maher Muoio

Testimony as Prepared for Delivery

May 17, 2023

Good morning, Chairwoman Pintor Marin, Vice Chairman Wimberly and members of the committee.

Thank you for the opportunity to come before you today to discuss the updated revenue forecasts for FY23 and FY24 budgets, as well as Treasury's departmental budget.

As always, with me today are my colleagues - Deputy Treasurer Aaron Binder, Acting Director of the Office of Management and Budget (OMB) Lynn Azarchi, Deputy Director of OMB Tariq Shabazz, and Martin Poethke, the Director of our Office of Revenue and Economic Analysis (OREA). I'd like to thank each of them, as well as my front office, and the staff of OMB, OREA, and a number of our other divisions, many of whom have joined us here today or are listening in remotely, for their tireless dedication and professionalism throughout this past year. I'd also like to add a special note of thanks to Lynn Azarchi, who will be moving on from OMB in the coming days. Lynn has been a valued member of the OMB and Treasury team since joining the division soon after graduating college, and her dedication and calm professionalism will be missed by all of us at Treasury.

When I last came before you six weeks ago, I remarked about how welcome a return to some revenue stability would be. After three years of turmoil, when we experienced precipitous drops in revenue followed by extraordinary growth, it appeared that revenues were beginning to settle back into more stable pre-pandemic growth levels.

As always, the all-important April revenues inevitably lead to adjustments to these forecasts when we appear before you in May. In 2021 and 2022 those adjustments resulted in increases in our revenue forecasts. Unfortunately, while we expected a decline in April revenues this year when compared to 2022, the returns of April 2023 are necessitating the need to adjust our revenue forecasts downward. It is important to note, however, that because of the work that has been done to improve New Jersey's financial condition and prepare the State Budget for fiscal challenges, the downward revenue adjustments I will discuss today are manageable and represent approximately two percent of our total revenues over the two fiscal years. We are well-prepared to handle this April Surprise.

The majority of the decline experienced was seen in the Gross Income Tax or GIT. While we had anticipated a 12 percent drop in April GIT collections following last year's record receipts, certain taxpayers realized income losses far exceeding expectations. April GIT collections declined by 27 percent. The main source of this drop lies with the annual 1040 return payments for Tax Year 2022, which were down 36 percent, or about $900 million below expectations.

New Jersey was not alone in experiencing these April declines. Connecticut, New York, Pennsylvania, Massachusetts, and even the federal government have also reported declines, some significantly lower than forecast. For example, Massachusetts missed its April target by over $1 billion and Connecticut by over $500 million, on a much smaller revenue base. The federal income tax collections weakness has reportedly hastened the arrival of the debt ceiling deadline. Fitch Ratings, in reporting on the weaker April income tax revenues being experienced by states, also issued a word of caution, stating that "[t]hose states implementing significant new spending plans or major tax policy changes could face additional budgetary pressure in the near and medium term, depending on the severity of the revenue slowdowns."

Preliminary 2022 tax return data suggest that net gains are the primary culprit for the GIT's underperformance and may have fallen by at least 55 percent. Stock markets were down in 2022, with the S&P 500 index declining by nearly 20 percent and the Nasdaq Composite falling close to 35 percent. Historically, stock declines have foreshadowed a down year for net gains, and this contributed to the year over year declines in April final payments forecast in the GBM. The actual April declines in net gains, however, were more in line with the declines seen following recessionary years – including the 2001 "Dot Com" recession, and the 2008-2009 "Great Recession" which resulted in 60 percent and 57 percent drops in net gains respectively, the worst declines on record.

2022, in other important respects, was a solid year economically, with growing wages, rising GDP, and steady gains in employment - not your typical indicators of a substantial income or revenue drop on the horizon. Indeed, quarterly estimated tax payments, which are largely from high-income taxpayers and a barometer for final payments, fell for Tax Year 2022, but only about 9 percent.

Net gains are disproportionately important for tax revenues because they are predominantly earned by high-income taxpayers. New Jersey's full-year resident returns generated about $33 billion in net gains in 2021, a remarkable jump of 58 percent from 2020. Much of this income is taxed at average marginal rates close to 10 percent, so these gains could yield some $3.3 billion in tax revenues. A 55 percent drop in such income may reduce GIT revenues by about $1.8 billion. To the extent that 2022 net gains may have declined by 20 percentage points more than expected, the actual revenue decline would have been about $660 million off target, accounting for the bulk of the $900 million April collections shortfall.

There are other factors at play, but the only other logical factor that may have had a material impact on GIT collections in April would be tax credits under the Pass-Through Business Alternative Income Tax (PTBAIT). As I suggested in my previous testimony, PTBAIT collections have largely settled and become more predictable. However, the corresponding impact of PTBAIT payments and the subsequent credits on GIT estimated and final payments may not be fully realized until the conclusion of this filing season. Still, the major cause of April's downward surprise this year lies in Tax Year 2022, and the significant decline in net gains. When the tax return processing, including extensions, is completed later this year, 2022 is likely to have witnessed the largest decline of net gains in a non-recessionary year. Perhaps the largest decline for any year.

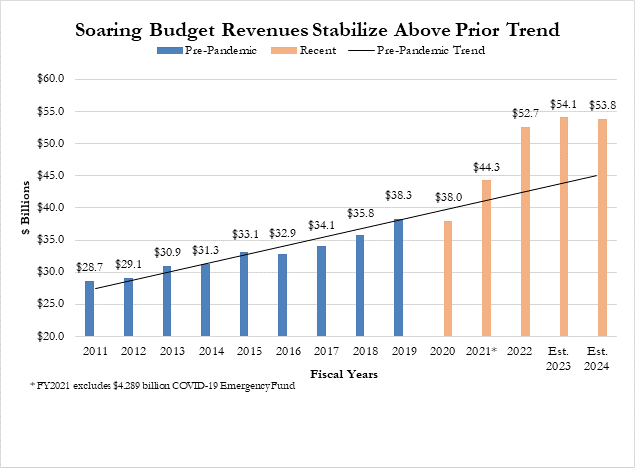

The good news is that not all revenue sources underperformed. GIT wage withholding collections, which annually account for about 70 percent of total GIT revenues, met expectations by growing 3.3 percent in April. The Sales and Use Tax, the State's second largest tax revenue, rose 6.7 percent, the strongest growth since September. Underlying economic conditions are moderating, but remain sound. While the GIT forecast has been reduced in both FY23 and FY24 due to our April numbers, some other revenue forecasts have been increased, partially offsetting the two-year impact. Indeed, the current year forecast remains $2.48 billion above the level certified last June with the Appropriations Act, and total revenues remain more than $14 billion above pre-pandemic budget levels.

In total, the FY 2023 revenue forecast of $52.8 billion is $1.2 billion lower than February's GBM forecast. The total FY 2024 revenue forecast of $52.8 billion is $1.0 billion lower than the GBM forecast. Key points for the revised forecasts include:

Additional revenue details are provided in the accompanying revenue table:

So, while the April Surprise once again provided a bit of a roller coaster ride this spring, our underlying fundamentals appear to be stable. The revenue boom that saw collections jump from a low of $38.0 billion in FY 2020 to $52.7 billion just two years later in FY 2022, has settled in. The revised FY 2023 forecast of $52.8 billion and FY 2024 forecast of $52.8 billion are a sign that stability has returned. But it has returned at levels far above the pre-pandemic years, providing us all the opportunity to right the budgetary ship and put the State on a fiscally responsible course.

Moreover, thanks to judicious fiscal planning, the State is in unprecedented shape to handle April's momentary revenue weakness. In the past, billion dollar revenue surprises precipitated emergency budgetary actions – sudden spending cuts, tax increases, and gimmicky fiscal maneuvers. But today we face no crisis. Even with the lower forecasts we are presenting today, we remain at record high revenue levels, and the State's surplus of $7.9 billion equals 15 percent of appropriations.

And despite this decline in revenue, the state's overall fiscal health is still stronger than it's been in more than a decade. As I testified in April, this budget continues our commitment to the pension with a full payment for the third year in a row. It continues our focus on debt reduction by including the full $2.35b deposit into the Debt Defeasance and Prevention Fund. And it provides the full $832 million increase in school aid as part of year 6 of the phase-in out lined in S-2. We have done all this while still maintaining a surplus of almost $8 billion.

It is this sound fiscal planning that precipitated four different ratings agencies – Moody's, Standard & Poors, Fitch, and Kroll – to each raise our State's bond rating in the weeks since we last appeared before you, bringing the total to seven rating upgrades in just fourteen months. And it will be our continued focus on sound fiscal planning that will position us to weather current and future financial challenges.

This is a budget we can all be proud of, and we look forward to working with you and the members of the committee in the coming weeks to finish the job.

Before we turn to questions, while my testimony this morning focused on the revenue update, there are, as always, also updates regarding other aspects of the budget, including appropriations. We are happy to entertain questions regarding any of this information, but because of the concerns specifically voiced over health benefit expenditures during the past year, I want to point out that one of the FY24 appropriation adjustments is an additional $33.6 million for health benefit costs based on trend.

With that, we are happy to now take any questions you may have related to the revenue update, and will then follow up with our departmental budget remarks.

DEPARTMENT HIGHLIGHTS

I'd like to turn to the work of our divisions and highlight some of the Department's accomplishments and efforts underway.

The Department of the Treasury is consistently at the forefront of many of the State's highest profile and most important initiatives, and our staff continually provides a high level of service and professionalism. Time and again, Treasury staff has delivered strong results in both their day-to-day work as well as when taking on new projects. Here are just a few examples:

On behalf of the Joint Management Commission, Treasury's Division of Property Management and Construction along with the New Jersey Building Authority, led the $283 million Executive State House renovation. The State House has received a Temporary Certificate of Occupancy. A phased re-entry began in March with the Governor and staff and was completed at the end of April. On May 1st, the Governor hosted an Executive State House Re-Opening event

The project was the result of almost one million hours of work. At the peak of construction there were nearly 250 workers on site at one time, and 14 different organized labor unions took part in the project. I'm sure we can all agree that the result is a Capital Building all New Jerseyans can be proud of and enjoy for decades. If any of you haven't toured the renovated space, I would encourage and welcome you to come take a tour.

DPMC also is working with various agencies on several projects that include the building electrification of a Treasury-owned office building currently under renovation at 135 W. Hanover Street, building a new MVC location in Newark, completing HVAC upgrades at the Department of Labor headquarters and the Richard J. Hughes Justice Complex, roof replacement at the Garden State Youth Correctional Facility Hospital, and working with the Department of Environmental Protection to complete renovation and repairs at several Revolutionary War sites at State-owned park facilities.

Starting in September 2022, the Division of Taxation took on the responsibility of implementing the ANCHOR property tax relief program, one of the most significant property tax relief programs in State history. Nearly 1.8M applications were filed – three times the number of applications received under the Homestead Benefit program it replaced. ANCHOR rebates have been successfully issued to over 1.6 million applicants, with payments totaling $1.8 billion in tax relief.

The Division's efforts to implement this program were exceptional. Taxation's staff answered over 145,000 phone calls and 51,000 email inquiries, and met with 11,000 in-person taxpayers, including over 1,500 on February 28th alone, with the last person walking through the doors at 11:59 pm to file their application. The automated inquiry system assisted over 350,000 taxpayers. Community outreach groups, Legislative offices, and local municipalities throughout NJ hosted over 30 outreach events in January and February to ensure taxpayer assistance was available, questions were answered, and applications were completed. A marketing campaign helped to drive a large increase in awareness and filings, specifically in the tenant population, and the application deadline was extended twice to further accommodate the demand for this wildly successful program.

Additionally, the Division of Taxation continues to administer important tax relief programs including the State's new Child Tax Credit, the expanded Child and Dependent Care Credit, the Senior Freeze property tax rebate program, and the expanded Earned Income Tax Credit.

During Fiscal Year 2023, the Office of Public Finance conducted a second round of bond defeasance following up on the successful conclusion of the Fiscal Year 2022 defeasance program. In total, $1.59 billion in debt was defeased using $999.3 million from the New Jersey Debt Defeasance and Prevention Fund. The Office also oversaw bonding for State infrastructure needs, including $750 million for the Transportation Trust Fund, $581 million for the Portal North Bridge project, and $160 million for the Economic Development Authority's Offshore Wind Port.

In addition, despite challenging market conditions, the Office of Public Finance completed a successful refunding of School Facilities Construction Bonds, saving the State $44.3 million on a net-present-value basis.

Our Division of Pensions and Benefits also had an extremely productive year.

The Division's Retirement Processing unit has calculated all eligible July 1st retirements in the queue for PERS, TPAF, PFRS, and SPRS – one month ahead of schedule. This is a major accomplishment. The Division's Call Center continues to make strides in its service and support of our pension and health benefits plan members, with answer rates for client calls running at 85%-90% and wait times currently averaging 3 – 4 minutes. The Division's Live Web Chat portal has expanded its service, assisting over 1,000 members per week. And the Division still offers old-fashioned client interviews for its clients, both in person or by video conference. Approximately 900 interviews are conducted each month.

Division and Treasury staff continue to work with stakeholders, labor members of the health benefits commissions and plan design committees, national health policy experts, and our health benefits consultants to develop sustainable solutions to the rising cost of health care.

The New Jersey Lottery continues to produce strong results. For the fiscal year that ended on June 30, 2022, the Lottery generated $3.634 billion in sales and contributed $1.11 billion to the State. The contribution was the largest in its history, exceeding the previous record, set in 2021. Lottery's sales for the current fiscal year that will end on June 30 have continued to be strong and are on track to exceed last year's sales and contribution.

Through April 2023, the Unclaimed Property Administration has successfully returned approximately $154 million to rightful owners and expects FY2023 will exceed the previous record of $162.9 million.

In January 2023, the UPA issued a $3.9 million contribution to the Affordable Housing Alliance (AHA) from the Unclaimed Property Utility Trust Fund. The amount represents the statutory requirement to send 75% of unclaimed property utility receipts to the AHA for use in assisting New Jersey residents in need with their energy costs.

The Division of Purchase and Property's Procurement Bureau has awarded 41 contract portfolios and 97 corresponding contracts so far in this fiscal year.

And in concert with its contracted eProcurement system supplier, Periscope Holdings Inc., DPP is providing a statewide approach to New Jersey procurement. This new solution has afforded over 383 municipalities, counties, and K-12 institutions, at no cost to them, the opportunity to leverage the State's NJSTART system for their electronic contracting needs. To date over 1,250 end users from these political subdivisions have user accounts.

In 2022 the NJ Division of Investment initiated a new investment program called the Emerging Managers Platform to increase and enhance the Division's ability to access smaller, off-the-radar investment managers, including women-owned and minority-owned investment management firms. Aligning with these objectives, the Division is hosting the NJ Private Market Emerging Managers Virtual Symposium on June 22, 2023. The objective of the event is to bring together interested parties including general partners, limited partners and other public pension plans to connect and learn more about New Jersey's Emerging Managers Platform. The event will include participation by the Governor, Treasurer, and the Chair of the State Investment Council.

These are just some of the many accomplishments and initiatives that Treasury staff have been responsible for in the year since I last presented our budget. Treasury continues to deliver high-quality results no matter the challenge.

I would like to thank each and every Department of the Treasury employee for their hard work and dedication throughout the past year.

I am happy to take any questions at this time.

*Attached are the supplemental budget charts