How Is Your Town or County Using Its COVID-19 Recovery Funds?

Find out how you can track the use of COVID-19 recovery funds where you live.

- Posted on - 02/11/2022

Where are these funds coming from, and how can they be used?

- Replace income lost by your city or town, such as tax revenue from loss of business

- Help communities respond to the public health crisis and economic issues caused by COVID-19

- Give extra pay to essential workers who are eligible

- Invest in water, sewer, and broadband infrastructure

For more detailed information on how else these funds can be used, click here.

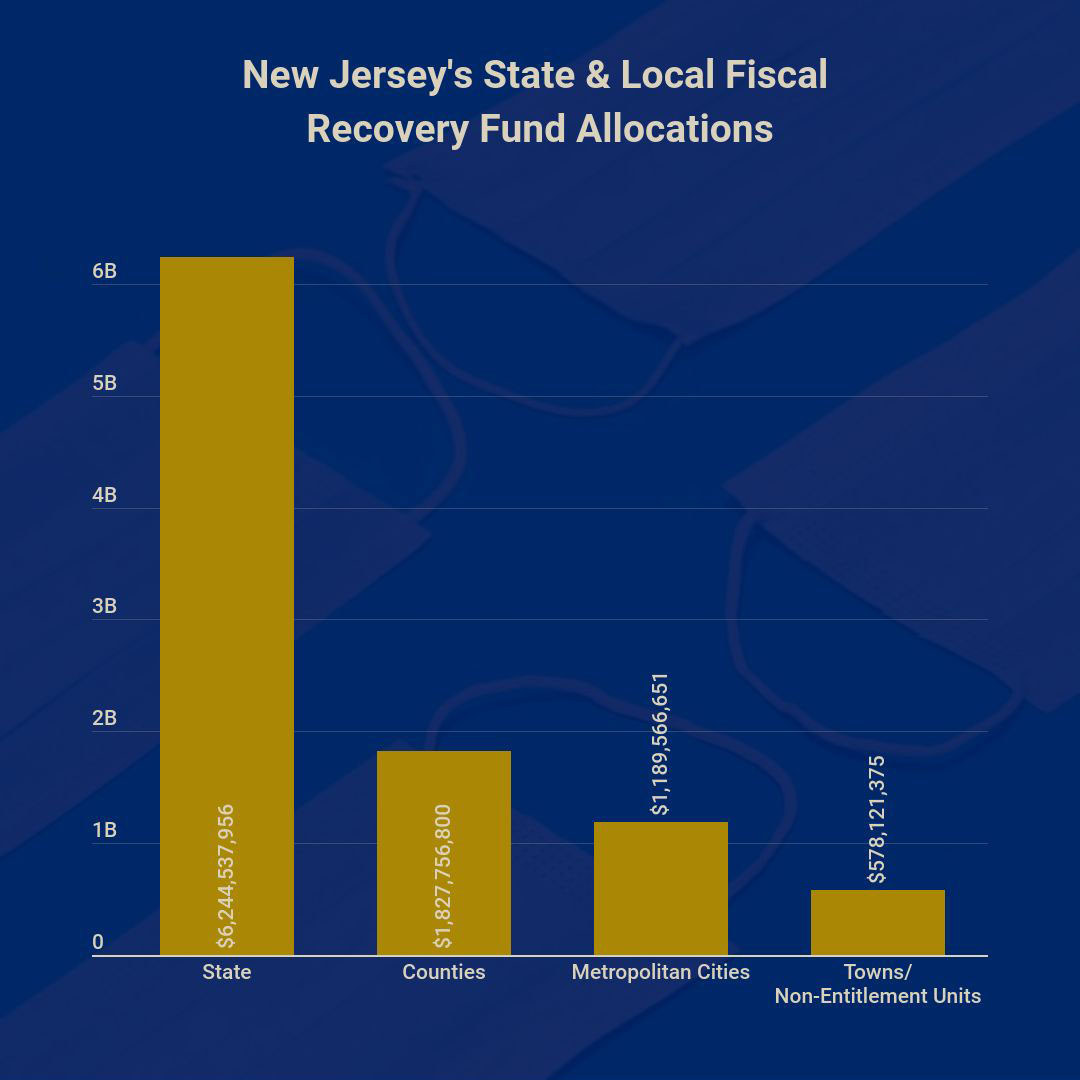

Towns and counties across New Jersey have received over $3.5 billion dollars from the federal government to help fight the COVID-19 pandemic and its effects on the economy. That’s in addition to the $6.2 billion the State has received.

Want to see how much your town or county received?

Click here for a breakdown.

Interested in how your town or county plans to use its Local Fiscal Recovery Funds?

If your town or county has a population over 250,000, it is required to post a public “Recovery Plan Performance Report” explaining their plans for using the funding.

Click the links below to see these reports.

Note: Some counties reported that they did not spend any of their Local Fiscal Recovery Funds prior to the due date of the first report and so did not post their Recovery Plans on their website. According to U.S. Treasury guidance, these entities still should have submitted a Recovery Plan describing the planned approach to the use of funds and planned projects.

If your town or county is not on this list, it is still required to submit a “Project and Expenditure Report,” to U.S. Treasury detailing its use of the funds.

Additional information on how your town or county is spending its Local Fiscal Recovery Funds may be found at usaspending.gov or pandemicoversight.gov.

If you want to know how the State is using the State and Local Fiscal Recovery Funds, you can see the State’s Recovery Plan here. You can also see detailed information about COVID expenditures on the “data tracker” section of the COVID-19 Oversight website.

Waste or Abuse

Report Fraud

Waste or Abuse

Official Site of The State of New Jersey

Official Site of The State of New Jersey