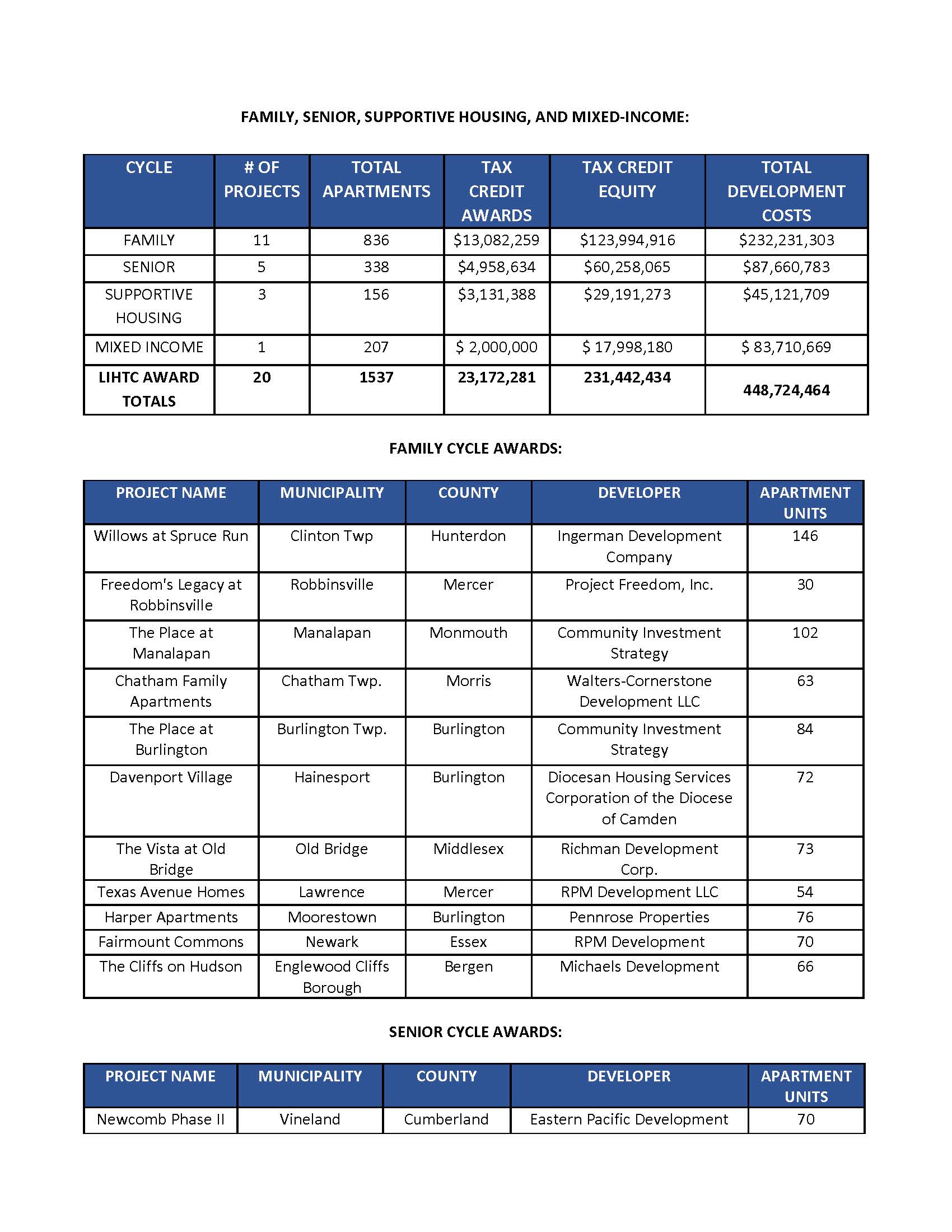

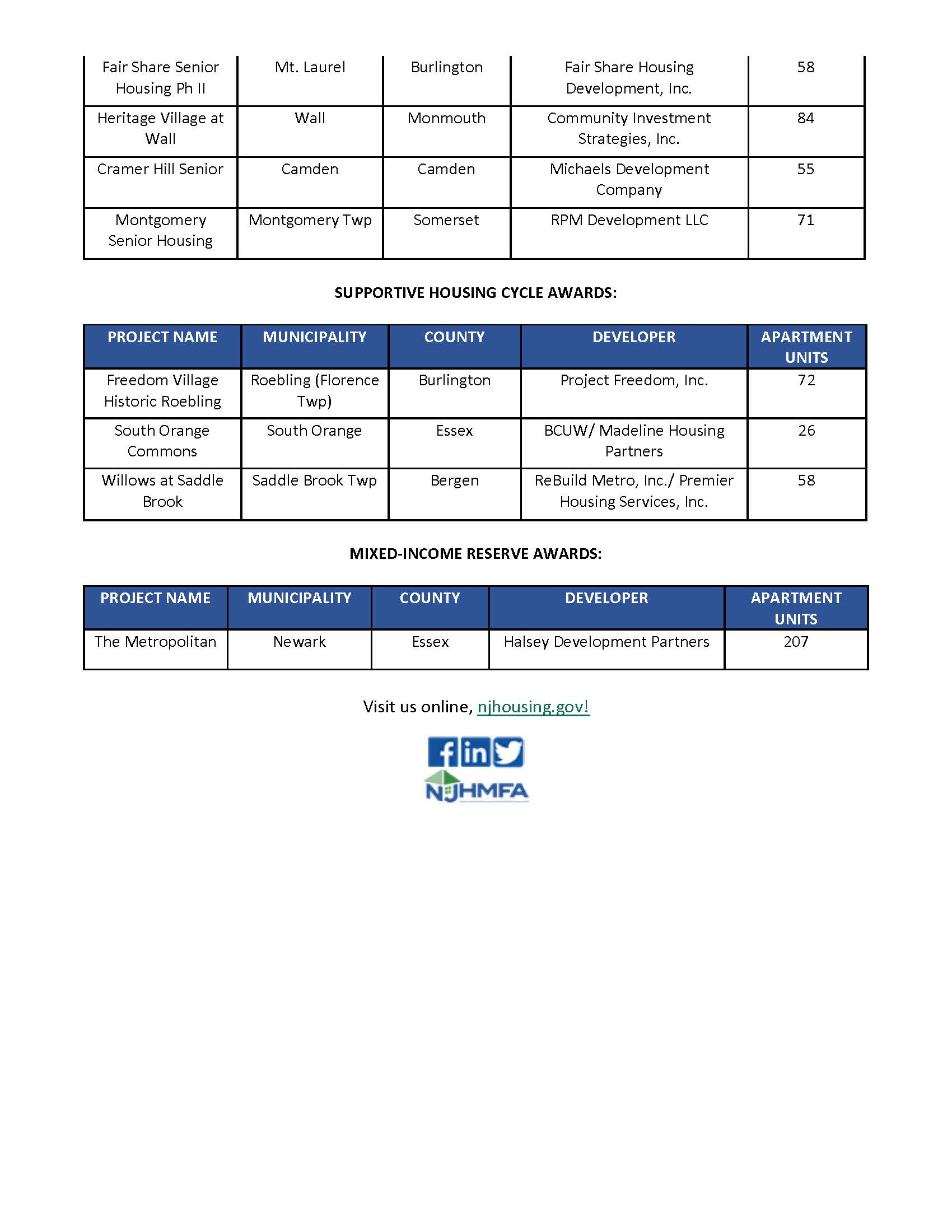

TRENTON –The Murphy Administration announced today it has awarded over $23.1 million in annual 9% federal Low Income Housing Tax Credits (LIHTC), which will lead to the construction of more than 1500 new affordable apartments for families, seniors and residents with special needs – helping to build a stronger and more equitable New Jersey. These tax credits are expected to generate approximately $231.4 million in private investment that will finance the construction of 20 developments across 11 of the state’s counties, producing a total of $450 million in new development.

This year, the Agency received an unprecedented number of applications for proposed developments in suburban municipalities seeking to enhance affordable housing opportunities within their borders. The highly competitive tax credit funding process supports the construction of the most impactful, diverse and inclusive housing proposals.

The LIHTC program, which was established by the Tax Reform Act of 1986, is the most prolific source of funding for new affordable rental apartments for residents in American history. Under the Murphy administration and with this year’s allocation, NJHMFA has awarded 9% tax credits toward the development of over 5,200 affordable apartments - including more than 2,000 affordable senior and supportive housing units – in communities across the state-.

“As the past two years have demonstrated, safe, stable housing is absolutely imperative to ensure the long-term health and economic stability of our families,” said Lt. Governor Sheila Oliver, who serves as Commissioner of the Department of Community Affairs and NJHMFA board chair. “Governor Murphy and I remain committed to the equitable development of affordable housing across the state. I am proud that the allocations this year will expand on the State’s historic FY2022 budget investment and produce more housing for all New Jersey residents.”

“New Jersey’s tax credit allocation plan uses objective criteria and targeted policy objectives to optimize our housing production capacity. This year's awards will boost housing in areas of high opportunity to incentivize economic opportunity for families and support older residents seeking to age in place,” said NJHMFA Executive Director Melanie R. Walter. “These awards represent a significant federal, state, community, and private investment in ensuring all New Jersey families can access sound jobs, good schools, and supportive services.”

For more information on NJHMFA programs, visit www.njhousing.gov.

Please click the button bellow for additional information on the projects awarded tax credits in the 2021 round.

Official Site of The State of New Jersey

Official Site of The State of New Jersey