Division of Risk Management

Division of Risk ManagementGeneral Public, Attorneys, Insurance Companies, etc.

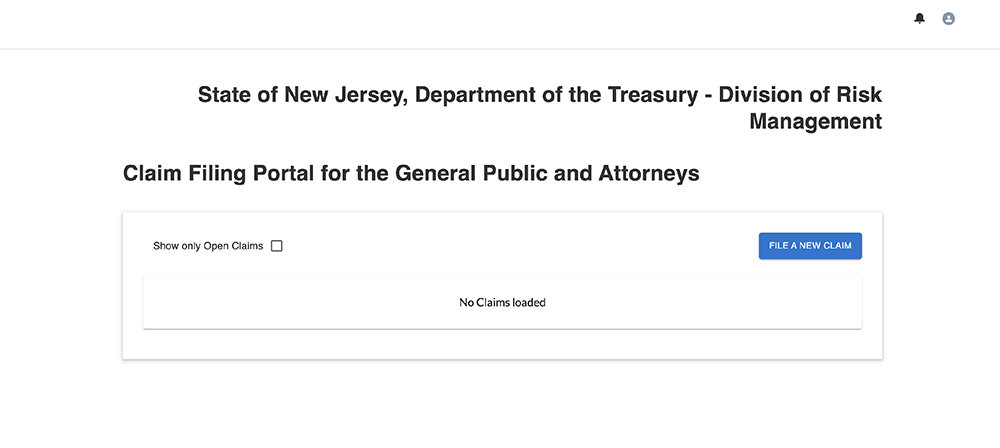

Effective July 11, 2024, all Tort and Contract Claims must be filed using the digital claim portal on this website by accessing the Tort Claim Login Page (PACFS). This includes, but is not limited to, claims for Bodily injury, property damage, automobile accidents, civil rights, false arrest, malicious prosecution, and Foster Parent Liability claims. Please note that if you have already filed a paper Notice of Claim in recent weeks, your claim may be converted to a digital format.

The claimant portal allows you to file and track the status and progress of all your claims. The portal also empowers you to amend the claim at any time after submission, and to upload documents when filing the claim, or at any time thereafter. For more information on the many benefits this claim portal offers, as well as critical information on the claim filing process, please click on the links below.

NOTICE OF TORT AND CONTRACT CLAIM: This form must be filled out by all individuals, attorneys, public and private entities that wish to file a Tort or Contract claim against the State of New Jersey, its Departments, agencies, officials, and/or employees related to any alleged wrongdoing or harm they suffered. This includes, but is not limited to claims for property damage, bodily injury, malicious prosecution, medical malpractice, wrongful imprisonment, employment related claims, and general civil rights. Claims against county or local-municipal agencies, cities or townships must be filed directly with them. Claims involving State Government employees that suffered injury in the course of their employment must be filed via a separate form (RM2) found on our website.

You must file your claim within 90 days from the date of occurrence, incident, accident, date of discovery, or accrual date, so as not to forfeit your rights. If more than 90 days has passed, please proceed to fill out and submit this claim form, followed by the filing of a Motion for Permission to file a Late Claim against a Public entity with the appropriate State Court. Please visit the Judiciary website and click on the “Self Help Center” tab. If and when the Court grants you permission to file a “late claim”, please upload a copy of said order in the corresponding tab by using the log in page on our website to access your case and claim. Please note that your claim will not be considered timely filed with the State of New Jersey until you have completed all required fields, signed the digital form, and clicked on the “Submit” button.

After you submit this digital claim form, there is no need to ‘file” with or send a paper version of the claim to any other State Government Department or agency. This form is intended to serve and satisfy the Notice requirements of the New Jersey Tort Claims and Contractual Liability Act a/k/a Title 59, as to the Notice of Claim only. All legal pleadings, civil complaints and other litigation and discovery tools and documents must be served in accordance with the Court rules.

Please note that if you are filing a claim for damages stemming from road conditions, it must be for State Highways only. Checking the police report, if available, will prove useful. Box #99 at the top left hand corner of the police report provides guidance (Box 4 in old version of Report). Codes 1-4 in boxes #4 and #99 would indicate State jurisdiction. Furthermore, claims for accidents on the Garden State Parkway, New Jersey Turnpike and the Atlantic City Expressway should be filed directly with said entity as noted below. This office does not handle their claims.

Listing Multiple Claimants on one (1) Digital Claim Form:

Please note that “Representatives” (Guardian, Parent, administrator/executor, party holding the power of attorney, etc. ) that suffered injuries or damages in the accident in question, may list themselves as claimants, in the “Additional Claimant” tab; but only after fist listing the injured/aggrieved party( minor, disabled, deceased, or incapacitated person) they represent as claimants.

Claims involving Rutgers University/Healthcare (General Tort and/or Medical Malpractice (i.e. State Prisons, etc.)):

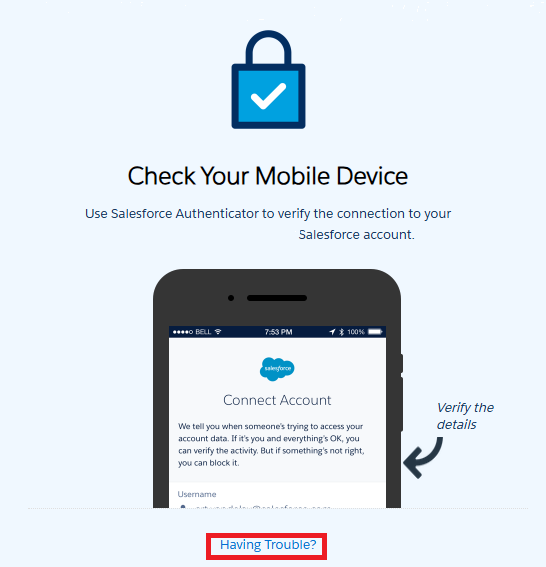

NOTE: This authentication process adds an essential layer of security to protect your account, ensuring that only you can access the tort claim login page, your claim history, and all of your documents.

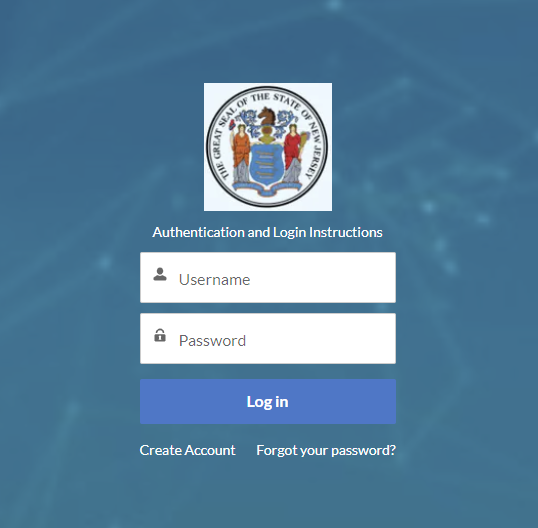

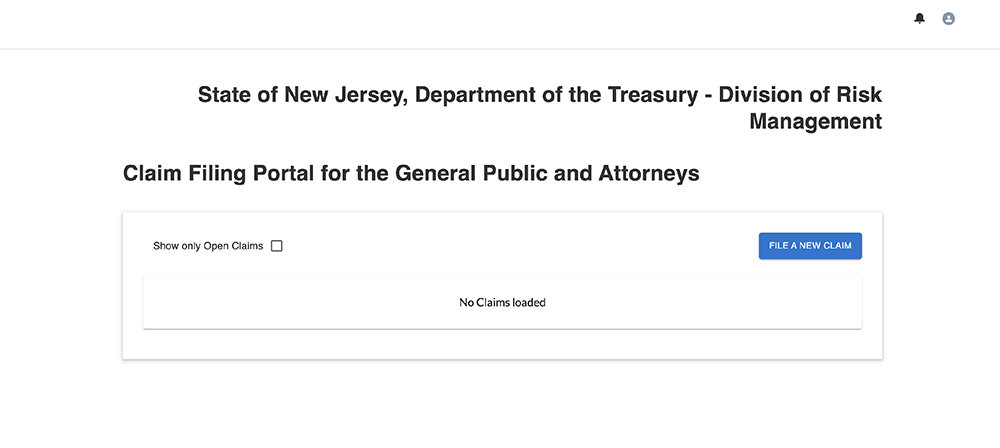

Step 1: To access the Claims Portal for the Public and Attorneys, please click on the: Tort Claim Login Page (PACFS)

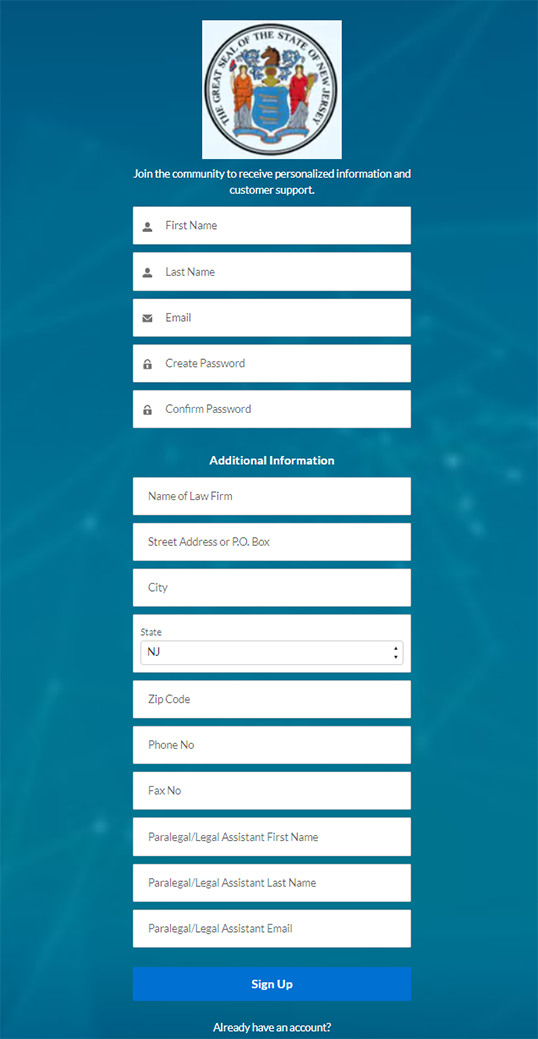

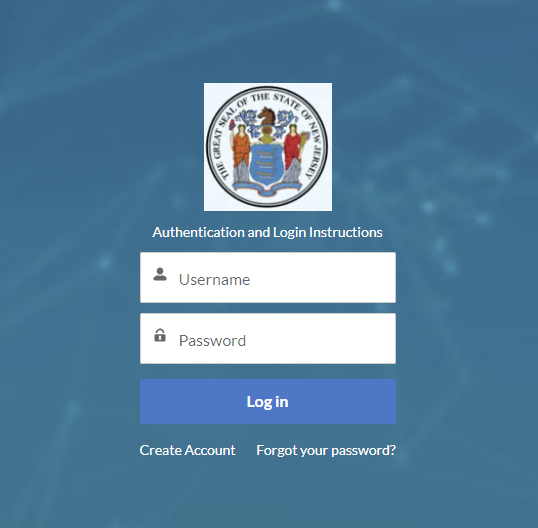

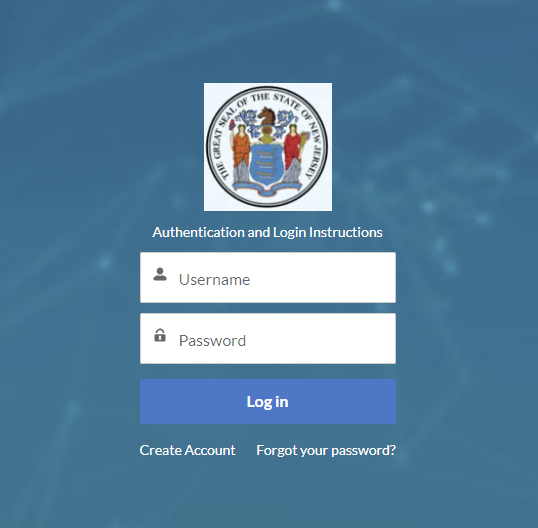

Step 2: For first time users, set up your account by clicking Create Account.

Step 3: Complete the registration process - enter your First and Last name, email address, create a password, and click Sign Up. Attorneys and their legal staff are encouraged to provide Additional Information to complete their account details.

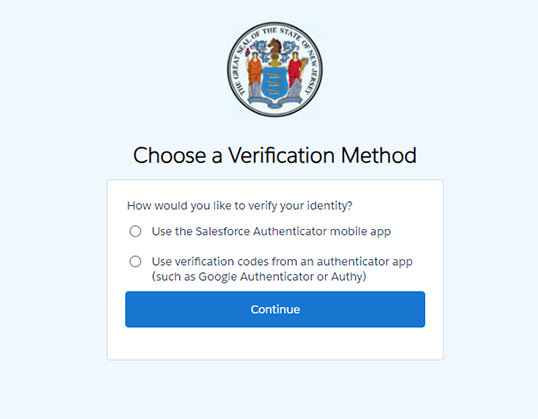

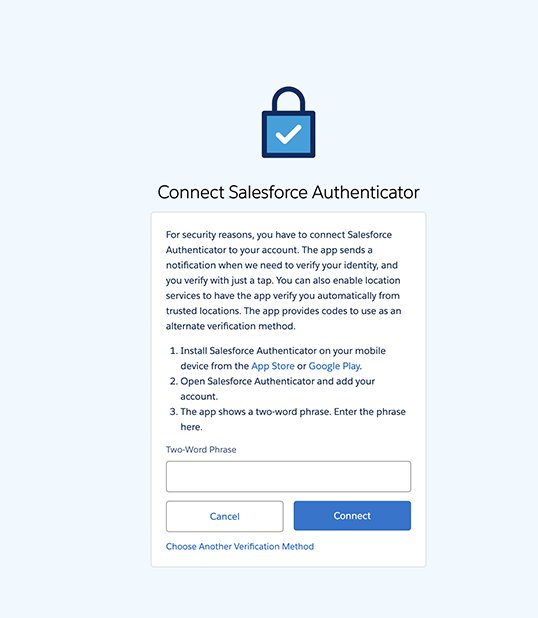

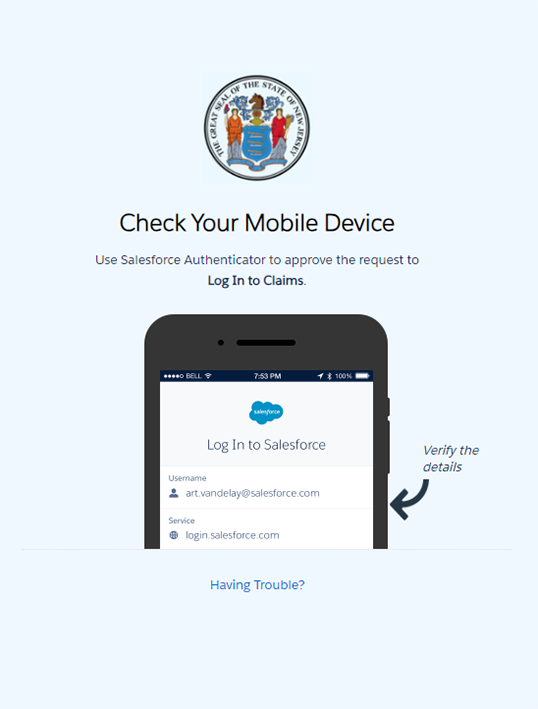

Step 4: You will be prompted to Choose a Verification Method: Google Authenticator, Authy, or Salesforce Authenticator (Preferred Method).

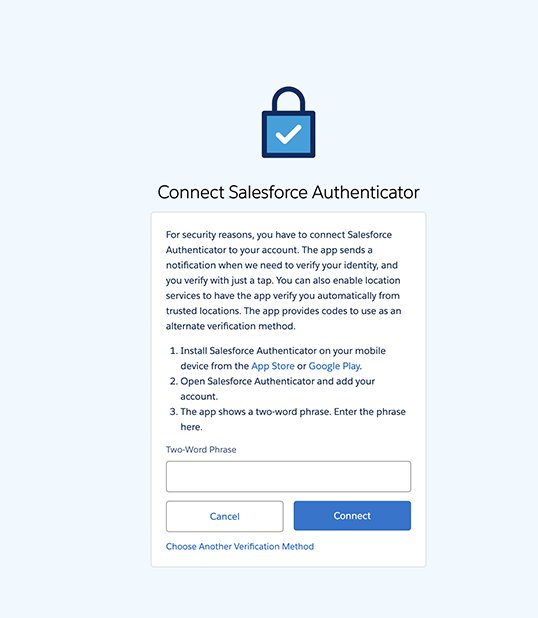

Step 1: To Secure your access via the Salesforce Authenticator mobile app, you will be asked to install Salesforce Authenticator to your mobile device from the App Store or Google Play.

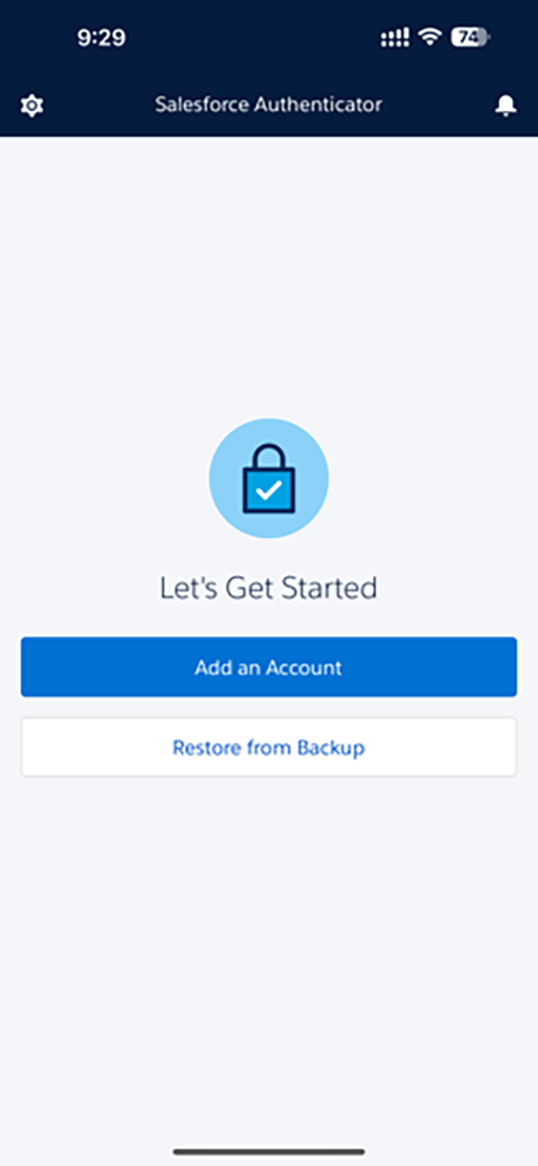

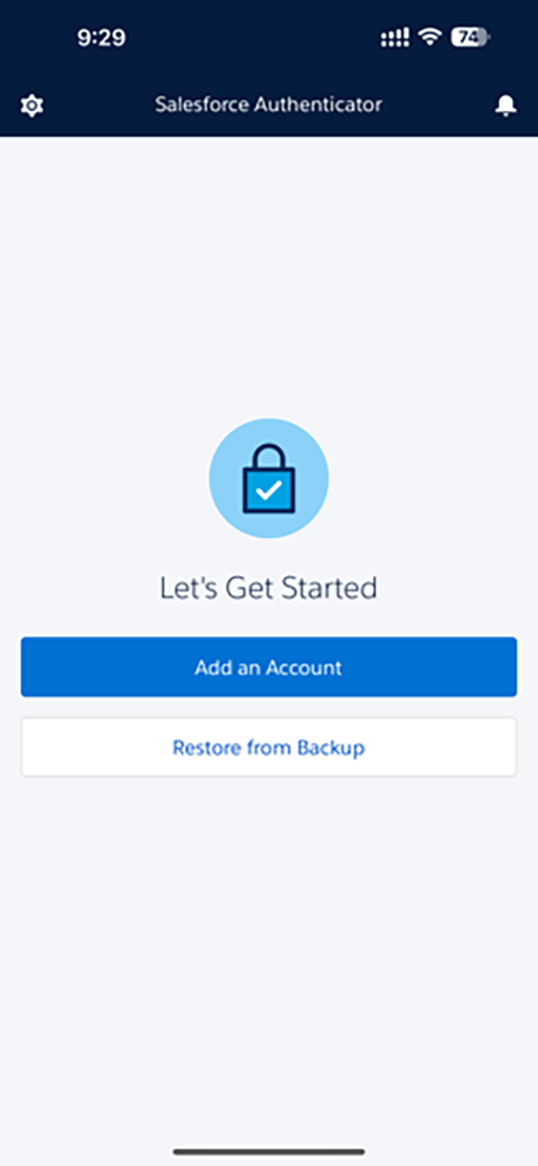

Step 2: Once the Salesforce Authenticator app is installed to your mobile device, open the app and follow the instructions on the screen. Click on Add an Account.

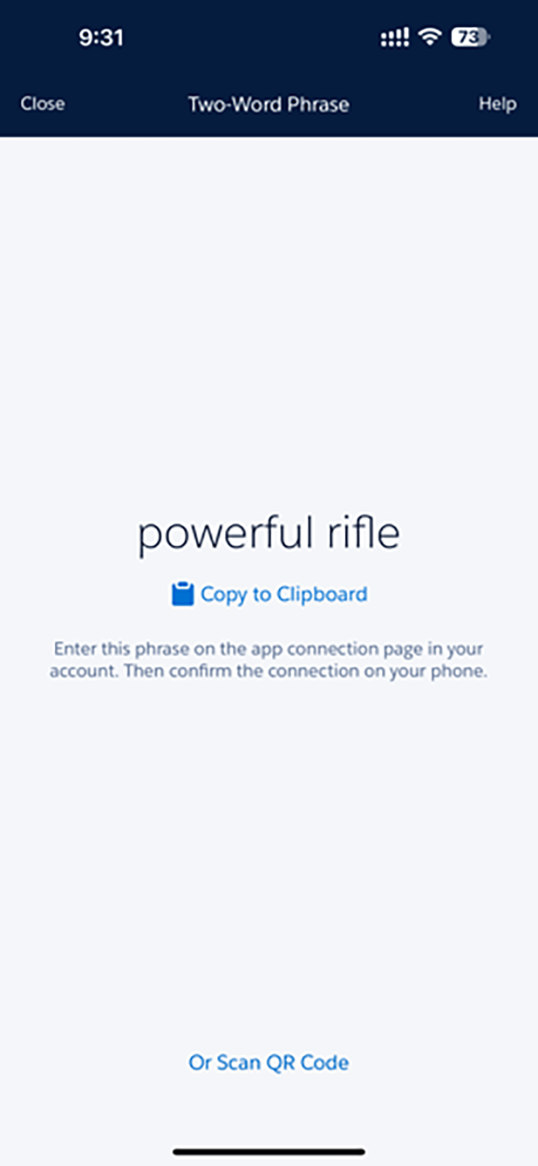

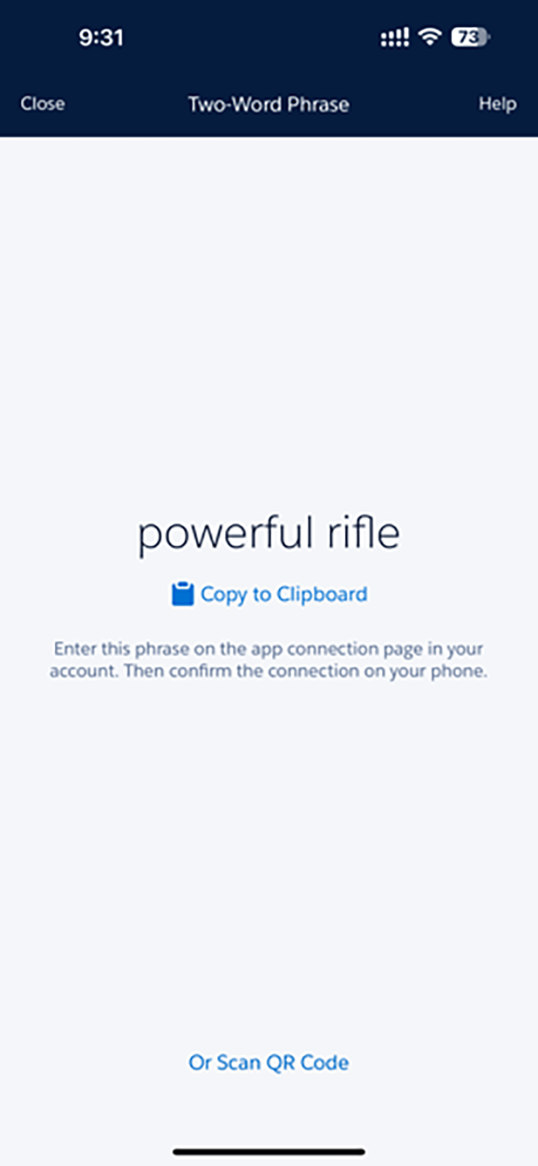

Step 3: A random Two-Word Phrase will be generated by the system and displayed on the mobile app.

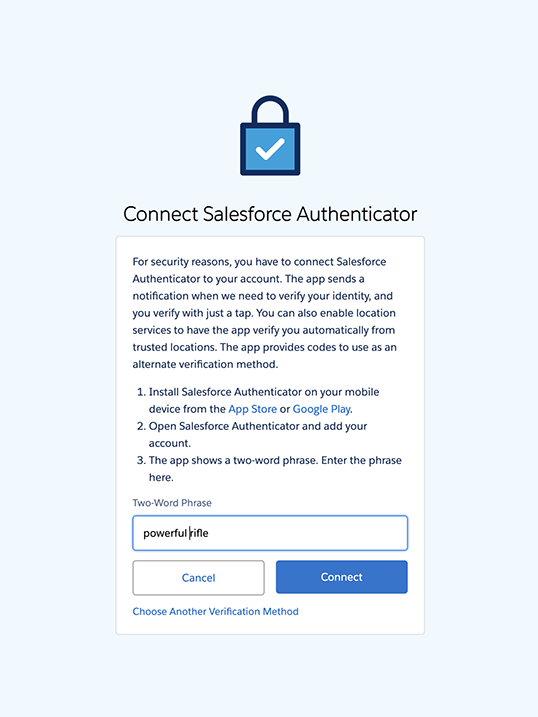

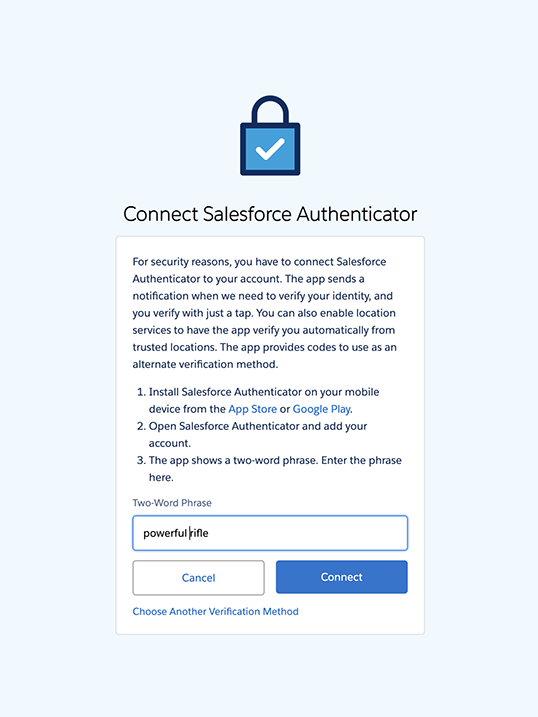

Step 4: Return to Connect Salesforce Authenticator page (Step 1), and enter the Two-Word Phrase to authenticate your account. Click Connect.

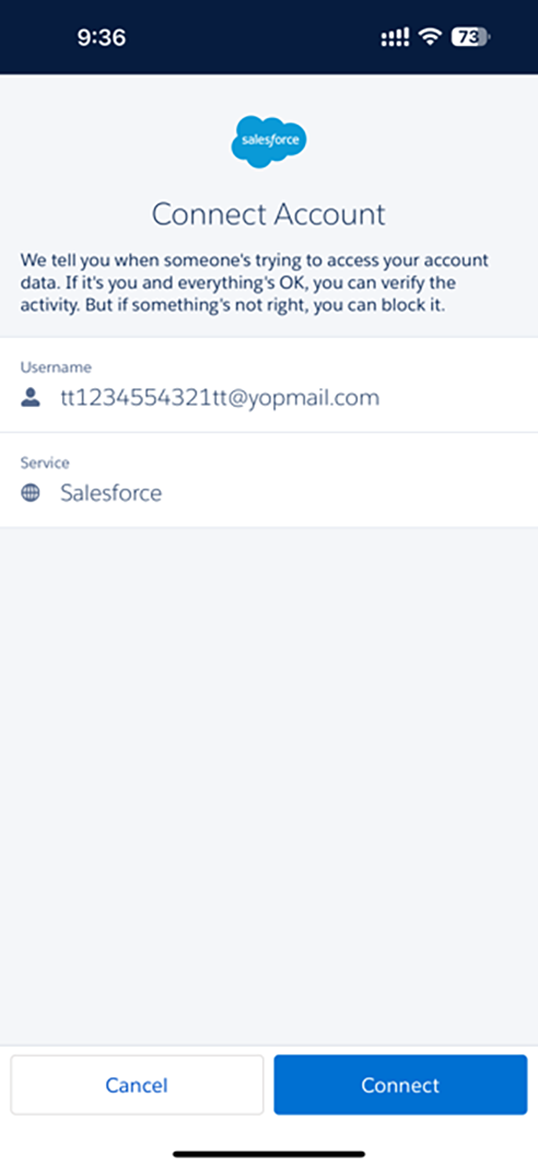

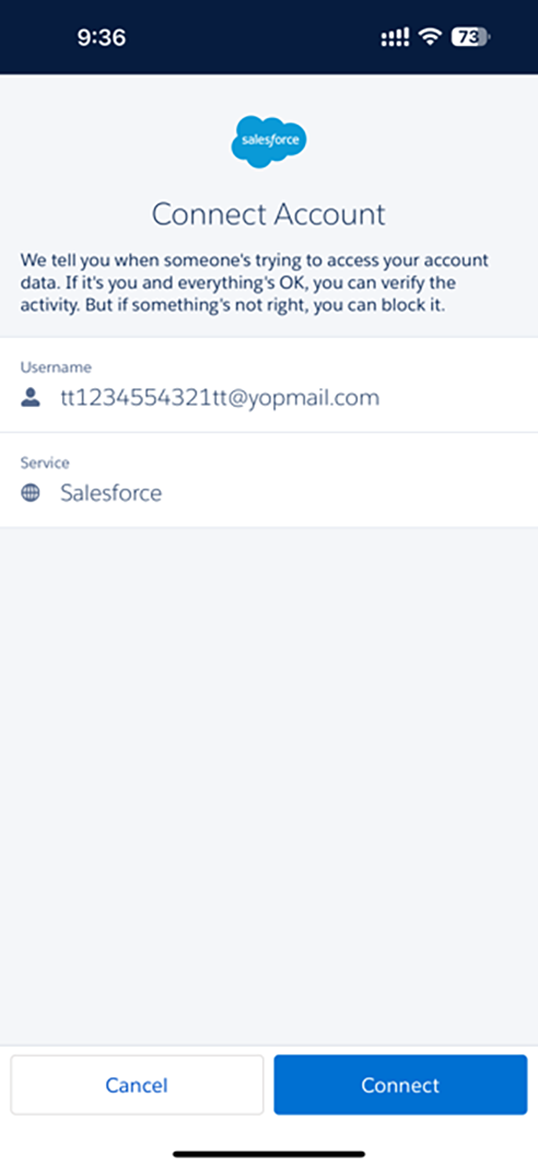

Step 5: The following screen will come up on the mobile app - Click Connect.

Step 6: The Salesforce Authenticator is now connected to your Claim Portal account.

Step 7: You will be automatically logged into the claim portal account.

Step 8: After completing the initial Salesforce Authentication set up (Steps 1 through 7), you will be able to access the Claims Portal in a few simple steps:

Visit: The State Division of Risk Management website and go to the claim login page: Tort Claim Login Page (PACFS)

Enter your Username and Password, click Log In:

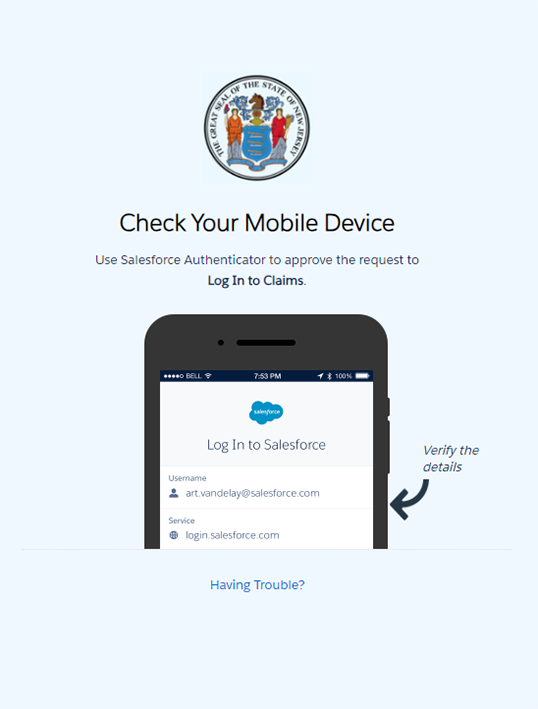

Check your Mobile Device and “Approve” access to the Claims Portal via the Salesforce Authenticator.

Step 1: To Secure your access via the Salesforce Authenticator mobile app, you will be asked to install Salesforce Authenticator to your mobile device from the App Store or Google Play.

Step 2: Once the Salesforce Authenticator app is installed to your mobile device, open the app and follow the instructions on the screen. Click on Add an Account.

Step 3: A random Two-Word Phrase will be generated by the system and displayed on the mobile app.

Step 4: Return to Connect Salesforce Authenticator page (Step 1), and enter the Two-Word Phrase to authenticate your account. Click Connect.

Step 5: The following screen will come up on the mobile app - Click Connect.

Step 6: The Salesforce Authenticator is now connected to your Claim Portal account.

Step 7: You will be automatically logged into the claim portal account.

Step 8: After completing the initial Salesforce Authentication set up (Steps 1 through 7), you will be able to access the Claims Portal in a few simple steps:

Visit: The State Division of Risk Management website and go to the claim login page: Tort Claim Login Page (PACFS)

Enter your Username and Password, click Log In:

Check your Mobile Device and “Approve” access to the Claims Portal via the Salesforce Authenticator.

Also, you would need to answer “YES” to question posed in the intake form under the “Automobile” section which reads as follows: “Does your accident involve a collision or incident with a State Government-Owned Vehicle or other motorized equipment (Includes leased or rental)”?

Vehicle Registration or License Suspension- MVC

Note: This is a stand-alone category. You are not required to select a companion category unless there are additional causes of action, such as the ones below.

This category includes damage to any property, building, structure, vehicle, equipment or item, and/or its loss of use. Please note that only the legal and registered owner of the damaged property, business, or vehicle (not the driver), may file a claim for property damage.

Pursuant to N.J.S.A. 59:9-2 (e), commonly referred to as the Collateral Source Rule, the money you are entitled to receive from an insurance policy shall be deducted from your claim against the State. In other words, private insurance funds are primary over taxpayers' money.

It is strictly up to you whether to involve your insurance company or not. Once liability is established, the State may reimburse you for the applicable deducible, and/or any other expenses not otherwise covered by insurance. Please ensure to upload the Declaration Page of the insurance policy that was in force on the date of accident (Auto, Homeowner’s, Business Property Policy, etc.), whichever applies in your case.

Bodily injury includes bodily harm, sickness, or disease, including resulting in death. It may also include emotional distress, psychological or psychiatric conditions stemming from the incident in question.

Please note that New Jersey is a no-fault state, which means that your own car insurance coverage pays for medical treatment and other related out-of-pocket losses incurred, no matter who caused the accident. In other words, your own automobile insurance policy or that of any member of your household covers your medical bills and other “No Fault” benefits. This applies whether you are a pedestrian, driver, or passenger in your own automobile or in any other vehicle, regardless of fault. In New Jersey, this coverage is called "personal injury protection" or "PIP".

Furthermore, if you or members of your household do not have automobile insurance coverage, then your own health insurance may be primary for medical bills, treatment and expenses. Please refer to N.J.S.A. 59:9-2e commonly referred to as the collateral source rule.

Please select this category for any incident or accident involving an automobile, truck, motorcycle, bicycle, scooter, lawnmower, or any other drivable motorized or manual equipment.

Should your accident or incident involve a collision with vehicles or motorized equipment owned by local townships, local police departments, or counties, please call the respective township/county or visit their website to file a claim directly with them. Should the collision involve a public NJ Transit bus or train, you should file your claim directly with said entity. Please visit the NJ Transit Website or call them at 973-275-5555.

If you believe that your claim involves an accident/incident with a State Government-owned vehicle or equipment, it is imperative that you: (1) immediately remove your vehicle from storage; (2) try to limit the use of a rental car to the time period when your vehicle is in the shop for repairs; and (3) file this claim as soon as possible.

Lastly, if your vehicle is in storage and/or you are currently renting a car, do not wait to obtain the police report before filing your claim. You must submit this form immediately after the accident to mitigate damages, and avoid being denied reimbursement for a portion of your out of pocket expenses. Please be prepared to scan and upload, at a minimum, the documents listed below unto the Document Upload Page at the end of this form:

Please select this category for any accident or incident that occurred on a State roadway or highway. Please do not file or submit this digital claim form if your accident involves one or more of the three (3) circumstances listed below.

Please note that the State accepts at face value, and as an undisputed fact your assertion that there was a pothole, debris, or other road hazard on the highway in question. The investigation is focused on whether the State had prior notice and sufficient time prior to the loss to have taken measures to protect against said dangerous condition. If you do not meet this stringent requirement or pierce the “prior notice” threshold, your claim will be denied. Please note that several other Title 59 immunities may apply.

The State’s liability is governed by the provisions of the New Jersey Tort Claims Act, N.J.S.A. §59:1-1, e.t... seq. (“Title 59”.) Title 59 significantly limits public entity liability, and historically, for matters such as potholes and similar road hazard property damage claims, the State has paid less than 1% of all claims made.

Lastly, please do not put yourself at risk of harm by trying to take pictures of the subject pothole or hazard on the highway. Photographic evidence is not required to prove your pothole/debris case.

Please select this category if the accident or incident in question occurred on a State government roadway, building, facility (owned or leased). This includes walkways, sidewalks, and parking lots abutting said structure.

Please note that incidents that occur on roadways, businesses, or property that are owned by private individuals/entities or local/county governmental agencies, should be filed directly with them. Our office does not handle their claims. Furthermore, said entities, businesses and individuals are responsible for the maintenance of sidewalks abutting their properties.

Please select this category if your claim involves allegations of deliberate, reckless, willful, or malicious destruction or defacement of public or personal property. A criminal charge or conviction is not a pre-requisite for the filing of a claim, as this civil claim category is separate and distinct from the criminal code. In certain instances, vandalism/criminal mischief claims may involve bodily injury or even death, in addition to property damage.

Please note that according to N.J.S.A. 59:5-4 “Neither a public entity nor a public employee is liable for failure to provide police protection service or, if police protection service is provided, for failure to provide sufficient police protection service.” In other words, a public entity is not liable in tort for its failure to protect against the criminal propensity of third persons, i.e. acts of vandalism or criminal mischief.

If you sustained damage on State property or grounds due to the criminal acts of third parties (whether identified or not), your claim could be denied. However, this absolute immunity may not apply if the alleged perpetrators that caused your damage were State employees or residents of a State facility, i.e. prisoners, patients at psychiatric hospitals, etc.

Lastly, if there was a private vendor that provided security at the State property, facility or grounds in question, we will refer the matter to their insurance carrier for handling. Our office may elect to deny the claim as to the State of New Jersey, while at the same time referring the matter to the vendor's insurance carrier.

Please select this category if you allege you were assaulted or abused by a State employee, or if said incidents occurred at a State facility, institution or building. Please note that assault and abuse may include, but are not limited to one or more the following:

Medical malpractice is defined as any act or omission by a physician or medical professional during treatment of a patient that deviates from accepted norms of practice in the medical community, and causes an injury to the patient. It could include misdiagnosis or delayed diagnosis, failure to treat, and/or Prescription drug errors.

This category applies to cases where a State Government employee, official or medical professional, or a company or individual under contract with the State of New Jersey to provide the medical services in question commits an act of medical malpractice.

For medical malpractice claims where you believe that some of the health care providers involved may be employed by Rutgers University, and/or the alleged medical malpractice occurred at a State Prison, please contact Rutgers Healthcare Risk and Claims Management hrcm@rbhs.rutgers.edu and/or file and submit your claim to Rutgers directly via this email.

Please select this category if you allege or claim one or more the following causes of action:

The three types of Claims covered by the Resource Family “Foster” Parent Liability Program are: (1) Damage to personal property of Foster Parent; (2) Damage to dwelling of Foster Parent; and (3) Third Party liability claims for property damage and personal injuries. The Damages proximately caused by the foster child must occur while the foster child is in the care of the Resource Family (Foster) Parent.

The Division of Risk Management does not entertain claims for $75.00 and under. Before filing this claim form, please refer to the list of exclusions section on page 8 of the Resource Family “Foster” Parent Liability Program to see if any apply to your case. Please be prepared to scan and upload the documents listed below:

Some basic examples of civil rights include, but are not limited to, the right to a fair trial, the right to government services, the right to a public education, the right to gainful employment, the right to housing, the right to use public facilities, the right to vote, and freedom of religion. It may also include discrimination, harassment, or retaliation because of your race, color, national origin, disability, age, sex, or religion.

Please note that filing this civil claim form with our office is separate and distinct from filing a civil complaint with the New Jersey Division on Civil Rights, Department of Law & Public Safety. You may contact the New Jersey Division on Civil Rights at 1-833-NJDCR4U (833-653-2748).

You may select this category if you suffered constitutional rights violation at the hands of State Government employees, officials, or an agency. Please ensure to click on “Civil Rights” also, when selecting this category.

If you are filing a claim for false arrest, malicious prosecution, wrongful imprisonment (MIA- Mistaken Imprisonment Act), and/or any other similar related legal claim, please use one the four (4) choices listed below as the date of incident or occurrence:

State Government Employment claims include, but are not limited to, wrongful termination; hostile work environment; harassment; failure or refusal to promote; and/or discrimination.

If you are alleging any accidental injury, occupational exposure or disease that arises out of, and in the course of your employment with the State of New Jersey, please do not select this category or file this digital claim form. Please visit our website and use the RM2 Workers Compensation Claim Form.

You may select this category if the contract, lease, or agreement in question was entered into with and/or executed by a State department, agency, or institution. However, if your claim is based on a contract, lease, or agreement with a private business, individual, municipal or county agency, you should file your claim directly with said private and public entities.

Contract claims under this category include but are not limited to the following:

The State of New Jersey Division of Risk Management (“DRM”) is, as a matter of public policy, entertaining and paying meritorious claims filed against the Motor Vehicle Commission (“MVC”), for reimbursement of expenses incurred because of MVC processing or record keeping errors. The DRM claim reimbursement program applies to cases where you are issued a ticket, summons, or where your vehicle is towed due to a reported suspended license or registration.

Any issues related to disputed transactions, overpayment or duplicate payments made to the MVC should be directed to them. Please refer to the MVC Refund Unit instruction and application form found on their website.

Please note that your claim with the Division of Risk Management will be denied if you failed to comply with one or more of the clear instructions, directions and guidance outlined in the three (3) MVC letters and notices listed below, or any other MVC notice you may have received. The denial will apply even if you produce an MVC letter, dated after the incident, showing that your license or registration has been restored retroactively, well before the date of occurrence.

The three (3) aforementioned notices specifically instruct you to, among other things, contact MVC, and provide proof that you paid the ticket and/or have valid auto insurance coverage, in order to avoid the scheduled suspension.

Lastly, it is imperative that you immediately retrieve and remove the vehicle from the impound storage lot to mitigate damages, and avoid accruing additional storage charges, which may not be reimbursable.

Note: Please also upload a PDF or photo of your license in the corresponding tab of the Document Upload Page at the end of this claim submittal process.

You may select this claim category for any incident or accident involving a State Government owned or leased helicopter that results in damage.

Please select this category only after you have read and reviewed all other claim and incident categories, and you have made a determination that the unique circumstances of your case do not fall under any of the categories listed herein.

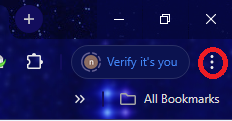

If you are experiencing an issue where the password reset link appears to be expired immediately after receiving it, please follow the steps below:

Important: Please read the following message before proceeding with amending your claim.

This amendment feature allows you to make changes to your claim form after it has been formally submitted. Please note the following:

It is imperative that you first try to amend the claim form using this portal before emailing the Division of Risk Management IT Customer Service staff for assistance. CustSvc.RiskManagement@treas.nj.gov

How do I edit or modify the claim form while I am completing it, and just before submitting the form?

The digital claim form allows you to remove a given field tab, clear data entered, and unselect any item you checked off. There is a “Back” and a “Next” button at the bottom of each page to facilitate moving through the form to change any selections or entries made. Furthermore, just before you sign and submit the claim form, you have the option of “Previewing” the entire claim form, and make any corrections you deem necessary.

Please note that while you may make changes to information entered in any of the fields, you will not be able to add or delete a specific Claim and Incident Category. Adding or deleting a Claim & Incident Category can only be done after the final submission of the claim form. Find the submitted claim in your Claim Portal and click on “Amend” under the Actions tab. This will allow you to change, add or delete a claim category, as well as add, delete or change an attorney-law firm.

Do I need to notify my insurance carrier?

No. You are under no obligation to notify your insurance company. However, you should note that if the injuries or damages you suffered are covered under your insurance policy, the State’s Tort claims fund is secondary. Therefore, our office would only cover your deductible, co-pays, or any other damages not otherwise covered or specifically excluded in your policy. In short, private insurance funds are primary over taxpayers’ monies. Please refer to N.J.S.A. 59: 9-2e, commonly referred to as the collateral source rule.

How long does it take to process my claim? When will I receive a response?

The timeframe for processing and investigating each claim varies. We ask that you allow up to 90 days from the date of claim submission for a possible resolution of your case.

I hit a pothole/debris on a State Road. When will I be reimbursed for the damages?

The State accepts at face value, and as an undisputed fact your assertion that there was a pothole, debris, or other road hazard on the highway in question. The investigation is focused on whether the State had prior notice and sufficient time prior to the loss to have taken measures to protect against said dangerous condition. If you do not meet this stringent requirement or pierce the “prior notice” threshold, your claim will be denied. Title 59 significantly limits public entity liability, and historically, for matters such as potholes and similar road hazard property damage claims, the State has paid less than 1% of all claims made. Please allow up to 90 days for a determination.

How do I upload additional documents onto the claim?

Sign into your claim portal and account, and click on the ACTIONS tab for the claim that you would like to upload documents, and select “Upload Document” from the drop down menu. The investigator on your case will receive a system-generated task alert identifying the document that you recently uploaded.

Will the State pay the medical bills related to my Tort Claim?

Our office may pay medical bills that are not covered by insurance, after it is determined that the State is legally liable for the incident in question. However, no payment will be made until the case is settled.

Please note that certain immunities may apply to your case, including the Tort Threshold requirement, which calls for the claimant to have suffered a permanent injury that is ‘substantial’ in nature. See N.J.S.A. 59:9-2(d).

Lastly, please note that this notice does not apply to work-related injury claims (RM-2 Report of Accident Injury or Occupational Diseases). This claim form is still accessible in the Forms tab. We will post an updated notice on this website advising users and potential claimants when these forms, and claim processes will be digitized, and migrated to our new cloud-based claims management system.

Note: You can email IT Customer Service and/or log in to a live zoom meeting with a tech representative on Mon/Wed/Fri from 11 a.m. - 12 p.m. or 3 p.m. - 4 p.m.