Federal Employees or Former Military Members

While unemployment eligibility rules are the same for federal employees, there are important differences related to documenting federal earnings. Review the information below before you apply to ensure proper processing and avoid payment delays.

If your separation was caused by a federal shutdown, pay special attention to your tax withholding. This is important because you will need to repay benefits if you return to work and receive retroactive pay.

The fastest way to submit a claim for unemployment insurance benefits is to use our online system. Alternatively, you can call 732-761-2020 to apply for benefits by telephone.

You may want to print a copy of this information to have with you while you are completing your unemployment application.

MILITARY

If you only had military employment in the last 18 months, you must be physically in New Jersey to apply here. If you have had both non-military employment in NJ and military employment in the last 18 months and are not physically in New Jersey, you can apply online using your non-military wages only. If you are not physically in New Jersey and have military and non-military wages and want to use both, you will need to speak to an agent to file your claim.

You'll need copies of your SF-8 and SF-50 forms.

- Online applicants: After you submit your application, you’ll receive an email with a link to follow-up questions and the ability to upload your SF-8 and SF-50. Complete this step as soon as you receive the email.

- If you didn't apply online: You can email or mail your SF-8 and SF-50. Emailing is the fastest option.

- Email: fedpayinfo@dol.nj.gov

- Mail (copies only–do not send originals):

Customer Service Unit – 8th Fl

PO Box 491

Trenton, NJ 08625-0491

You’ll need copies of your DD-214.

- Online applicants: After you submit your application, you’ll receive an email with a link to follow-up questions and the ability to upload your DD-214. Complete this step as soon as you receive the email.

- If you didn’t apply online: You can email or mail your DD-214. Emailing is the fastest option.

- Email: fedpay@dol.nj.gov and include your Claimant ID# in the subject line

- Mail (copies only–do not send originals):

Customer Service Unit – 8th Fl

PO Box 491

Trenton, NJ 08625-0491

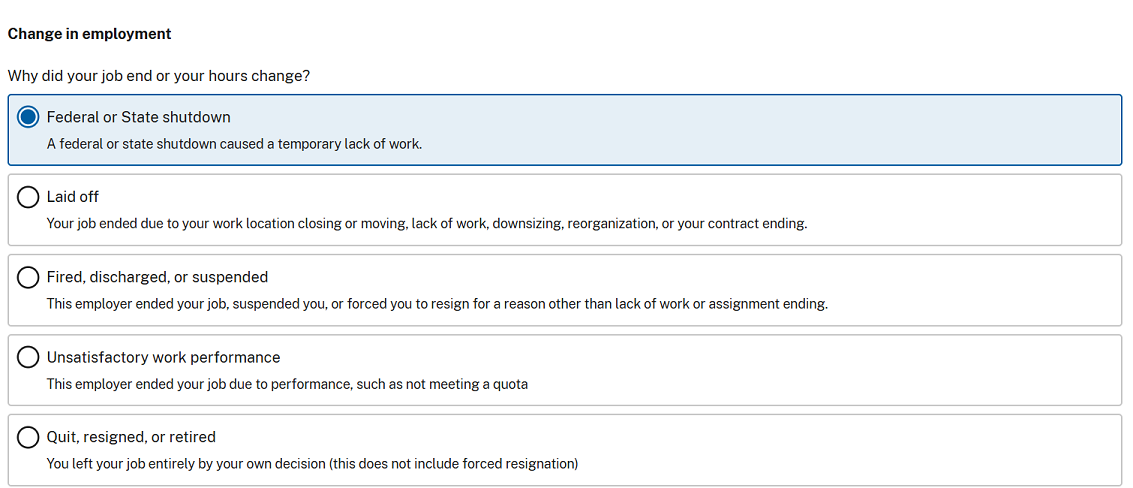

Important: Use the last day you worked before the shutdown as the date when completing the application and select Federal or State shutdown as seen below for the Change in employment.

On the application, you’ll be asked if you want 10% of your unemployment benefits withheld for federal income tax.

- If you choose yes, we will send 10% of your benefits to the IRS.

- However, if you are later recalled to work and receive full retroactive pay, you will need to repay 100% of any unemployment benefits received, even the taxes that were withheld.

- You will not be eligible for a waiver for any overpayment of benefits paid to you for a temporary federal shutdown.

Example:

If you qualify for $100 of benefits and choose to have your unemployment benefits withheld for federal income tax:

- You will receive $90 in benefit payments

- $10 will go to the IRS

When you are recalled to work and receive full retroactive pay, you will still need to repay the full $100 in benefits.

We cannot provide tax advice, so we encourage you to consult a tax professional if you have questions.

If you worked for the federal government in the last 18 months and don’t have a copy of either your SF-8 or your SF-50 form, you should complete your unemployment application as best you can, and submit it as soon as possible. After you submit, you will receive an email with a link to submit a copy of your SF-8 and SF-50. If you don’t have them, contact your former employer to get a copy sent to you. You can’t receive payments until you have submitted copies of those forms.

Special note for employees separated due to federal shutdown: if you do not have access to your SF-8/SF-50, file your claim and Division staff will work with you to obtain the information needed.

The Deferred Resignation Program (DRP) was a program that was offered by the Federal government to allow for federal employees to voluntarily leave their position and receive continuation pay for a set period of time, most ending on September 30th, 2025.

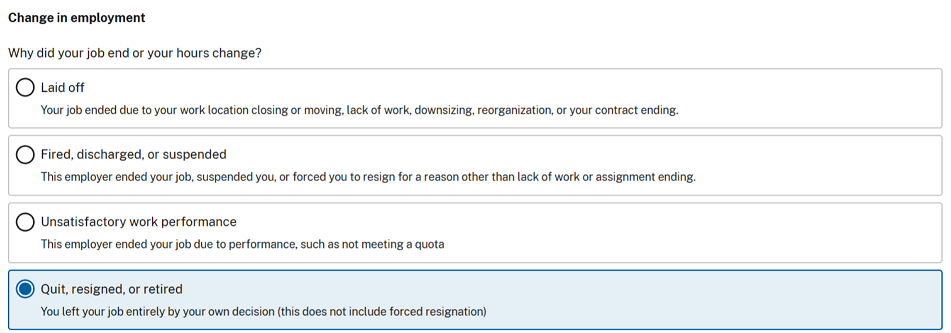

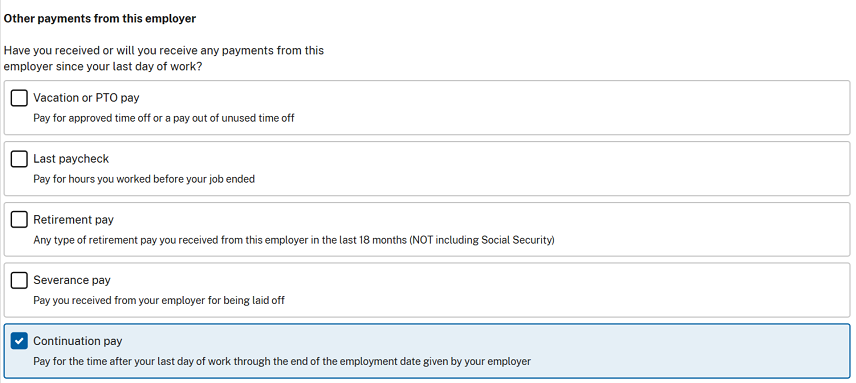

If you accepted this package, and are now filing for unemployment, you must indicate your separation as “Quit, Resigned, or Retired” (Example 1 ), that you received continuation pay (Example 2), and that your final day of work matches the end date on your agreement, in most cases that date will be September 30, 2025 (Example 3). Your separation and your pay after last day of work will be reviewed to determine your eligibility for benefits.

Example 1:

Example 2:

Example 3:

If you worked for the military in the last 18 months and don’t have a copy of your DD-214 form, you should complete your unemployment application as best you can, and submit it as soon as possible. After you submit, you will be asked to upload a copy of your DD-214. If you don’t have it, use eVetRecs to request a copy. You can’t receive payments until you have submitted a copy of this form.

Official Site of The State of New Jersey

Official Site of The State of New Jersey